Is Now the Right Time to Buy? A Look at Mortgage Rates and Market Conditions

Guest insights from our preferred mortgage partner, Generations Mortgage

With mortgage rates still hovering above 6%, many buyers are wondering: Why aren’t rates coming down, and is now really a good time to buy? To help bring clarity, we’ve partnered with Generations Mortgage for an in-depth look at the economic factors behind today’s rates and what they mean for you.

From inflation and treasury yields to market trends in the Sacramento region, this update breaks down what’s happening, what to watch for, and why current conditions may actually present a smart buying opportunity, especially with price reductions and seller concessions still on the table.

Read on for timely insights and expert guidance to help you navigate the current market with confidence.

Explore Price Drops Near Sacramento

Mortgage rates continue to be a hot topic in today’s real estate market, and many are wondering why they haven’t come down yet. According to Generations Mortgage, the answer lies in the performance of the 10-Year Treasury yield. As the yield rises or falls, mortgage rates tend to follow. Several factors—including inflation, employment data, and even tariffs—can influence the yield’s movement.

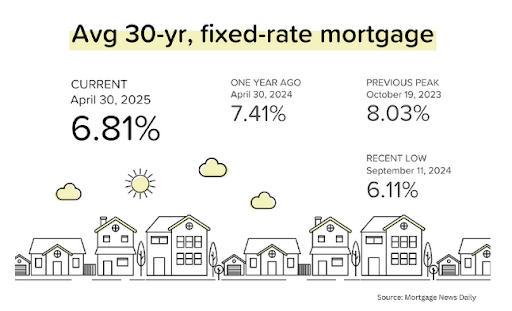

A good rule of thumb: add approximately 2.4% to the current 10-Year Treasury yield to estimate a 30-year fixed mortgage rate. For example, as of this writing, the 10-Year Treasury yield is 4.456%, while the average 30-year fixed mortgage rate reported by Mortgage News Daily is 6.81%.

Photo Courtesy of Mortgage News Daily

Inflation Reports Spark Market Attention

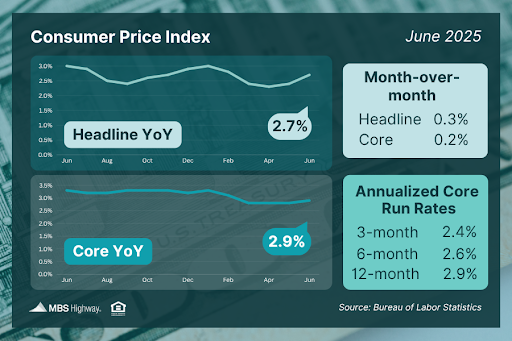

This week brought two important inflation reports: the Consumer Price Index (CPI) and the Producer Price Index (PPI)—both of which influence mortgage rates.

- CPI (Consumer Price Index): Measures the cost of goods and services consumers pay. The latest year-over-year CPI came in at 2.7%, with energy and shelter costs being key drivers.

- Core CPI (excluding food and energy) Rose to 2.9%, the highest since February, decreasing the likelihood of a Fed rate cut in the near term.

- PPI (Producer Price Index): Tracks the wholesale cost of goods and services. The year-over-year PPI fell from 2.7% to 2.3%, while Core PPI dropped from 3.2% to 2.6%.

Smart Home Buys in Yolo County

This is encouraging news, as lower PPI today may help bring down future CPI readings, potentially easing inflation and supporting lower mortgage rates.

Photo Courtesy of Bureau of Labor Statistics

So far, tariff-related inflation pressures appear to be limited and manageable.

Discover Hidden Gems in El Dorado County

What Does This Mean for Buyers?

Despite headline noise, inflation appears more controlled than many realize, and the mortgage market remains in a relatively stable holding pattern. If inflation continues to trend below 3%, mortgage rate improvements could be on the horizon.

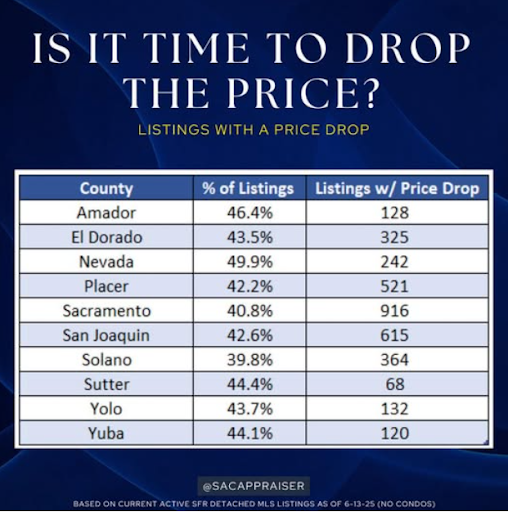

Photo Courtesy of The Sacramento Appraisal Blog | IG: sacappraiser

Right now, many buyers are sitting on the sidelines waiting for lower rates. However, current market conditions may actually present an opportunity:

- Higher inventory means fewer offers per property.

- Appraiser Ryan Lundquist reports that homes listed between $500K and $1M in the Greater Sacramento area (Sacramento, Placer, and El Dorado counties) are receiving an average of just 1.5 offers per listing.

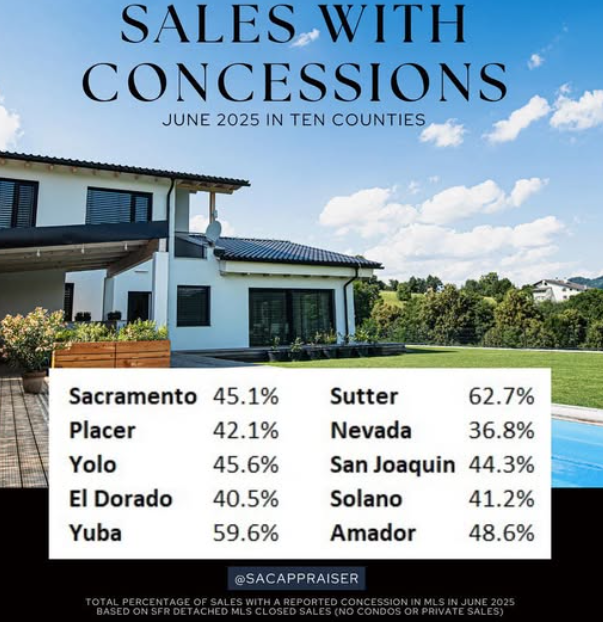

- Over 40% of recent sales in these counties included seller concessions, and 42% of active listings had price reductions.

Photo Courtesy of The Sacramento Appraisal Blog | IG: @sacappraiser

With less competition, buyers today can take advantage of these incentives, potentially negotiating seller credits to help buy down their interest rate or cover closing costs.

Search Homes with Seller Incentives in Placer County

When rates eventually drop, the flood of re-engaged buyers will likely drive up competition, reduce concessions, and eliminate many of today’s cost-saving opportunities.

Photo Courtesy of The Sacramento Appraisal Blog | IG: sacappraiser

If you’re considering buying, Generations Mortgage encourages you to explore your options now. Their team of expert advisors can help you craft a strategic home financing plan tailored to your needs, so you’re prepared to act whether rates shift next week or next quarter.

About Generations Home Loans

Our vision is to be a driving force in transforming lives through homeownership, shaping a future where every client achieves lasting financial security and generational wealth. We aim to set the standard for integrity, expertise, and meaningful community impact, building a legacy of successful clients and thriving partnerships for generations.

Generations Home Loans is a trusted mortgage provider dedicated to helping families achieve their dreams of homeownership. With a history of excellence and innovation, the organization offers tailored lending solutions to meet each client’s unique needs. Its experienced team of professionals provides personalized guidance and expert advice, empowering borrowers to build wealth and long-term stability through owning a home.

To find out more about home loan options or get pre-approved, please visit

www.generationshomeloans.com

Generations Home Loans is an Equal Housing Opportunity Lender (Company NMLS #252939). Generations Home Loans has a business relationship with Windermere Real Estate.

Category In The News, Real Estate

Windermere Signature Properties

With the California Local blog, Windermere Signature Properties strives to deliver the most valuable information to both home buyers and sellers while highlighting our favorite local gems that make Sacramento the best place to live in California. DRE# 00182401