Brace for Impact: The Fed Waits While the Market Wobbles

In a normal market, flat PCE (inflation), slower job growth, and contracting GDP would have caused a rally in bond prices and a fall in bond yields (and mortgage rates). But with the market braced for widespread economic impact, pre-tariff data is being largely ignored.

Fed Breakdown

On Wednesday, May 7, the Fed concluded its 2-day meeting and left rates unchanged. Powell used the word “waiting” 22 times – Clearly, the Fed does not know the future direction of the economy and thinks it’s OK to wait, rather than do a preemptive cut. Powell said, “The costs of waiting to see further are fairly low, we think, so that’s what we’re doing.” But the Fed has explained many times that their actions have long and variable lags, which means if they were to cut, it would not even show up in the economy until at least 6-9 months later.

Many believe that the Fed is making a mistake, just like they did in 2022, by waiting. The Fed is currently restrictive by more than 1%, even after cutting 100bp since last September. A 25bp cut would help the markets and give them a good sign, but the Fed would still be restrictive.

Powell said that even after the -0.3% Q1 GDP print that the economy expanded at a solid pace. That’s debatable, as there are many reports showing softness.

Search Sacramento County Homes in Today’s Market

Chinese Trade Talks

Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng met this past weekend in Switzerland, marking the first official trade talks since the U.S. imposed 145% tariffs on Chinese goods. The high-level meeting focused on easing tensions and finding common ground to de-escalate the ongoing trade standoff, which has significantly disrupted commerce between the world’s two largest economies.

Case-Shiller: Price growth slowed, but still strong

Case-Shiller’s national home price index rose 0.3% month-over-month in February, with year-over-year price growth decelerating to +3.9% (from 4.1% previously).

In February, six of the big city indexes decreased month-over-month, up from just one (Tampa) in January. I’ll be watching this closely as the year progresses.

Pending home sales boosted by lower rates

In March, average rates on 30-year mortgages were 20–30 basis points lower than in February. That, together with more homes available for sale, was enough to lift NAR’s Pending Home Sales Index by 6.1% – an index level consistent with existing home sales of 4.2–4.3 million SAAR.

Jobs week off to a weak start!

JOLTS: Job openings down significantly

In March, the total number of job openings fell 4% MoM to 7.2 million (-11% year-over-year) as hiring stayed subdued and the job quits rate remained low. [BLS]

ADP: Just 62,000 jobs added in April

That was about half of what the market was expecting, and is the lowest monthly figure in nearly a year. Large companies (>500 employees) only added 12,000 jobs, and three of the nine census regions saw net job losses.

See what’s available now in Placer County

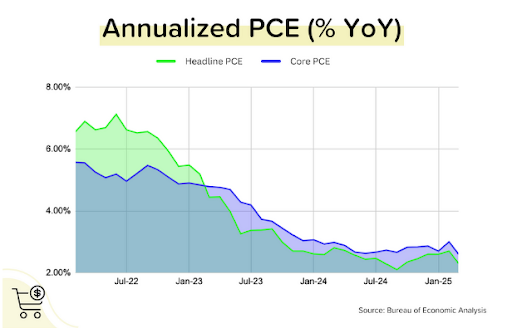

PCE (inflation) for March shows flat prices

When the Fed talks about its 2% inflation target, it’s referring to the “core” PCE (Personal Consumption Expenditures) index. In March, both “headline” and “core” (inflation without food & fuel prices) PCE indexes were flat month-over-month, which allowed annual “core” inflation to drop from +3.0% YoY to +2.6% YoY. We’re oh so close! [BLS]

Photo Courtesy of Bureau of Economic Analysis

On the Case (Shiller)

The Case-Shiller index is the gold standard for measuring home price growth because it uses the repeat sales method (looking at ‘pairs’ of transactions for the same home) to more accurately gauge true appreciation. However, this accuracy comes at a cost: a nearly two-month time lag.

Overall, the February 2025 results were solid but showed a general deceleration of home price growth. The seasonally-adjusted national index rose 0.3% month-over-month (vs. +0.6% in January). Still, if you annualize the last 3 months of price growth, you get 5.2% — not bad at all.

Explore El Dorado County Homes Now

Here’s a look at the 20 biggest city indexes in detail. Here’s what we found:

- The biggest MoM increases came from Charlotte (+0.78%) and New York City (0.75%), while the highest YoY growth came from New York City (+7.7%) and Chicago (+7.0%).

- Six cities saw their seasonally-adjusted price indexes go backwards in February (Dallas, Denver, Phoenix, Portland, San Diego & Tampa). In January, only one city saw a decline (Tampa).

- Tampa’s index has declined in 9 out of the last 12 months. Still, with the Tampa index having risen 69% between end-2019 and end-2024, giving back 1–2% is hardly a disaster!

- There are 6 cities that still haven’t yet fully recovered from the second half of 2022 price falls: San Francisco (-5.0% from peak), Denver (-1.2%), Phoenix (-0.8%), Dallas (-0.7%), Seattle (-0.6%), and Portland (-0.6%). Notably, most of these cities saw their indexes decline in February. In other words, they are getting farther away from setting new highs.

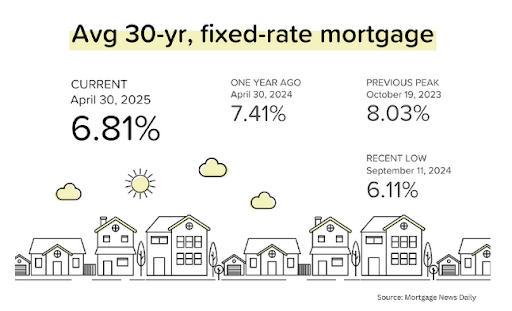

Mortgage Market

With uncertainty (and volatility) at unprecedented levels, average 30-yr mortgage rates have been hovering around 6.8% for several weeks. It is virtually impossible to handicap the full impact of tariffs (inflation up or GDP down?) or the Fed’s reaction. Additionally, new trade “deals”, tariff exemptions, delays, or outright walk-backs could easily flip the script.

Here’s what the Fed Funds Rate futures market is currently pricing in for rate cuts. Note that the current Fed Funds Rate policy range is 4.25–4.50%.

- June 18 FOMC Meeting: 33% probability that the policy rate will remain at 4.25–4.50% (about the same as last week). 64% probability that the policy rate will be 25 bps below current (in other words, a 25 bps rate cut at this meeting). 3% probability that rates will be 50 bps below current (a 50 bps rate cut at this meeting).

Photo Courtesy of Mortgage News Daily

They Said It “Unease is the word of the day. Employers are trying to reconcile policy and consumer uncertainty with a run of mostly positive economic data. It can be difficult to make hiring decisions in such an environment.” — Nela Richardson, ADP’s Chief Economist

“Home buyers are acutely sensitive to even minor fluctuations in mortgage rates. While contract signings are not a guarantee of eventual closings, the solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled by ongoing job growth.” — Lawrence Yun, NAR’s Chief Economist

Check out listings in Yolo County

As we move forward, the housing market remains in a delicate balance, with mixed signals on price growth, mortgage rates, and buyer activity. While some cities are experiencing price deceleration, others are seeing notable gains. Mortgage rates have remained relatively stable, but the uncertainty around future Fed actions and economic factors continues to create volatility. Despite this, the rise in pending home sales suggests continued demand, fueled by lower mortgage rates and more available homes. As the market adapts to these conditions, potential buyers and sellers will need to stay agile and informed to make the most of the evolving landscape.

About Generations Home Loans

Our vision is to be a driving force in transforming lives through homeownership, shaping a future where every client achieves lasting financial security and generational wealth. We aim to set the standard for integrity, expertise, and meaningful community impact, building a legacy of successful clients and thriving partnerships for generations.

Generations Home Loans is a trusted mortgage provider dedicated to helping families achieve their dreams of homeownership. With a history of excellence and innovation, the organization offers tailored lending solutions to meet each client’s unique needs. Its experienced team of professionals provides personalized guidance and expert advice, empowering borrowers to build wealth and long-term stability through owning a home.

To find out more about home loan options or get pre-approved, please visit

www.generationshomeloans.com

Generations Home Loans is an Equal Housing Opportunity Lender (Company NMLS #252939). Generations Home Loans has a business relationship with Windermere Real Estate.

Category Real Estate

Windermere Signature Properties

With the California Local blog, Windermere Signature Properties strives to deliver the most valuable information to both home buyers and sellers while highlighting our favorite local gems that make Sacramento the best place to live in California. DRE# 00182401